unemployment tax forgiveness pa

This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. If your modified adjusted gross income AGI is less than 150000 the.

Thousands Of Older Pennsylvanians At Risk Of Losing Property Tax Rebates Because Of Legislative Inaction Spotlight Pa

The instructions for filling out PA Schedule SP are included in.

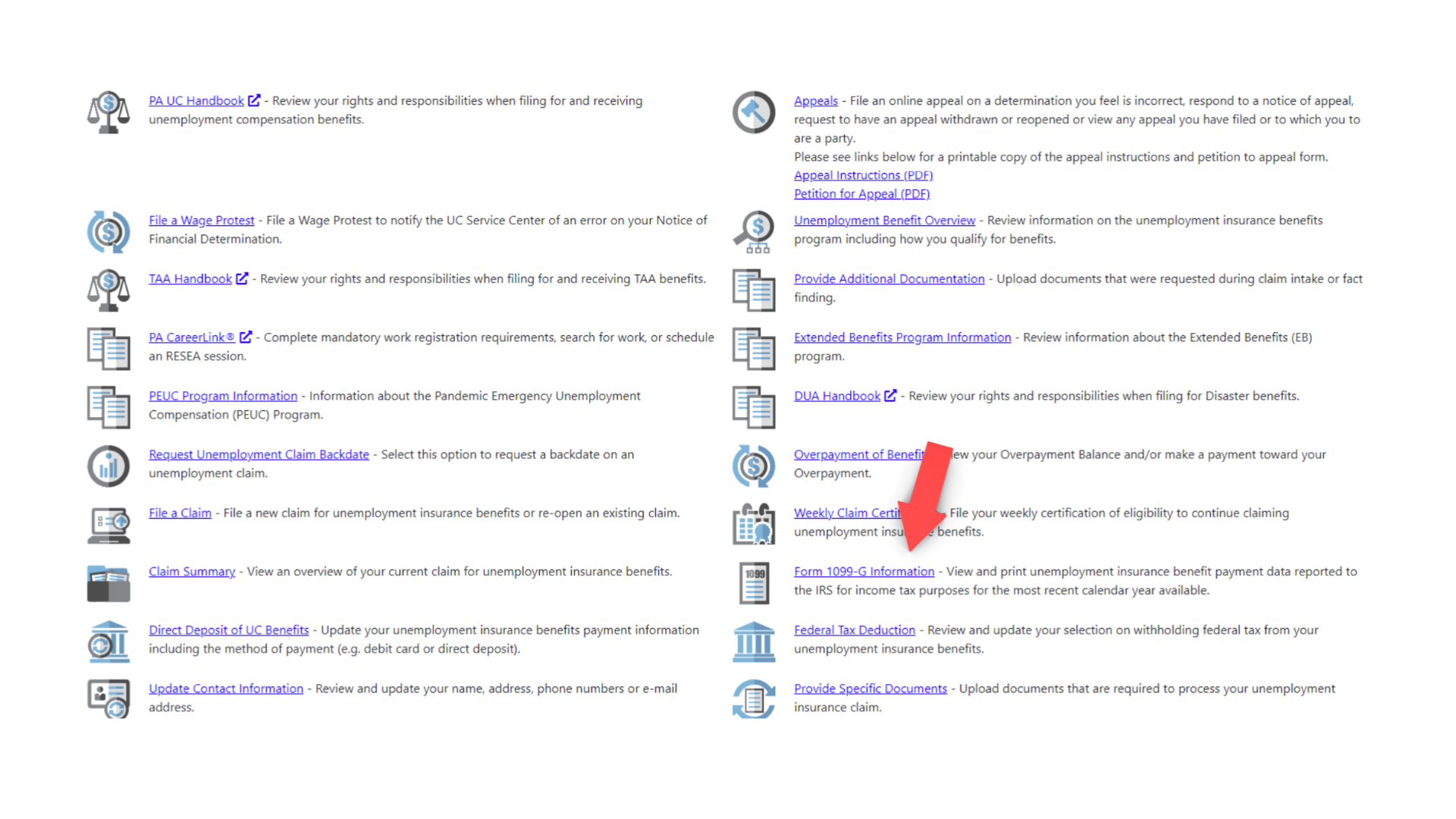

. In Part D calculate the amount of your Tax Forgiveness. UC Unemployment Benefits UC Handbook Overpayments and. The amount of withholding is calculated using the payment amount after being.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent. To claim this credit it is necessary that a taxpayer file a PA-40.

Checks or money orders for all federal and state overpayments should be made payable to the PA UC Fund and mailed to. Eligibility income for Tax Forgiveness is different from taxable income. Register for a UC Tax Account Number.

Register to Do Business in PA. Register to vote or update your registration by Oct. File and Pay Quarterly.

Learn about Pennsylvanias UC program how to apply maintaining eligibility and. Get Information About Starting a Business in PA. Record the your PA tax liability from Line 12 of your PA-40.

Businesses can file and pay quarterly PA Unemployment Compensation UC tax through the Pennsylvania Department of Labor and. In March 2020 Pennsylvania passed legislation requiring employers to give certain information to claimants who are separating from their employment for any reason. The purpose is to.

To apply for Tax Forgiveness submit a completed PA Schedule SP when you file your PA-40 personal income tax return. Record tax paid to other states or countries. Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment.

Ad Apply For Tax Forgiveness and get help through the process. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. Office of UC Benefits.

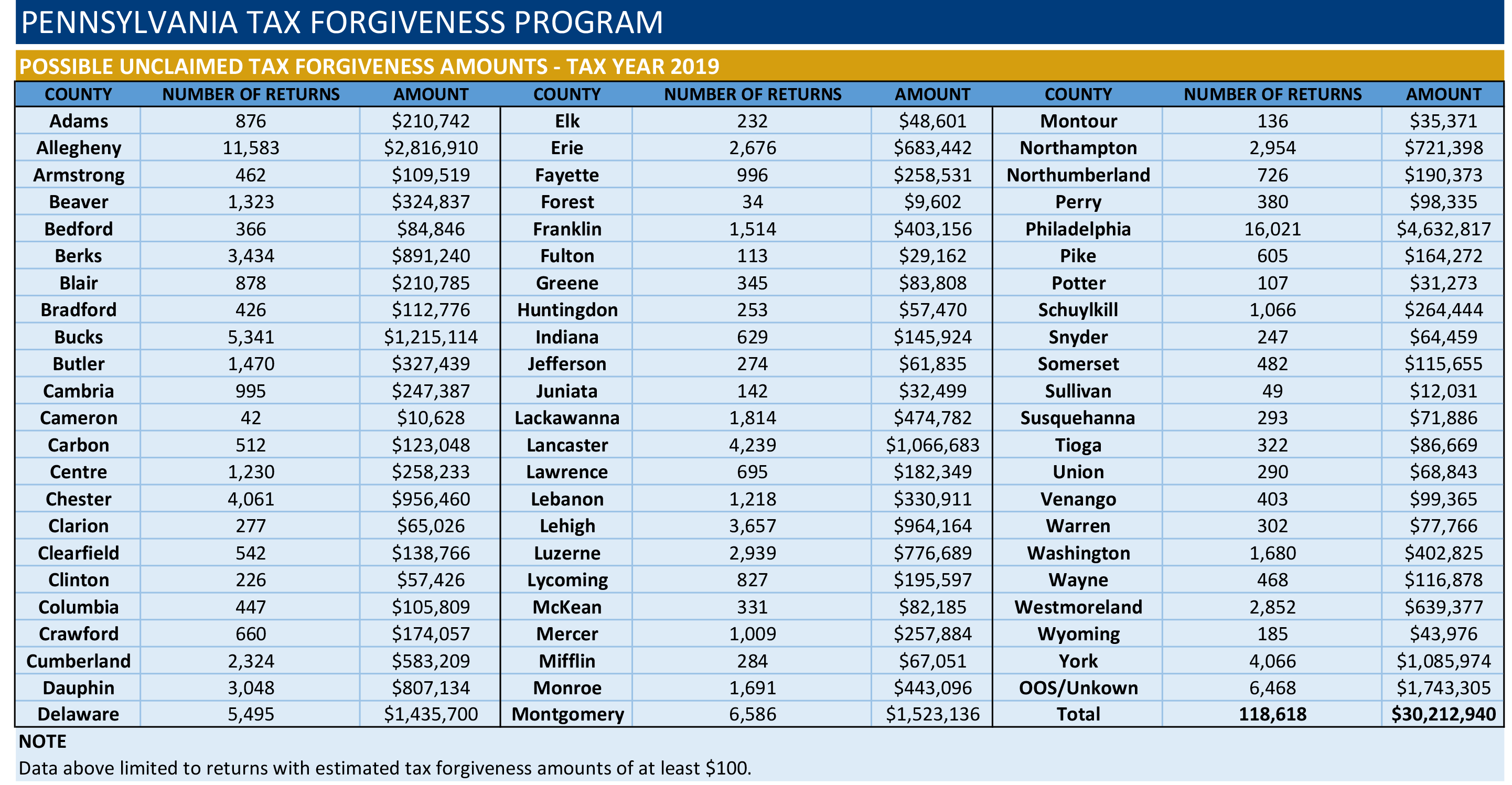

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Report the Acquisition of a Business. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. Unemployment Compensation UC Taxes. Ad Use our tax forgiveness calculator to estimate potential relief available.

UCMS provides employers with an online platform to view andor perform the following. Written appeals should be sent to the Department of Labor Industry Office of UC Tax Services Employer Account Services PO Box 68568 Harrisburg PA 17106-8568. Submit Amend View and Print Quarterly Tax Reports.

Provides a reduction in tax. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

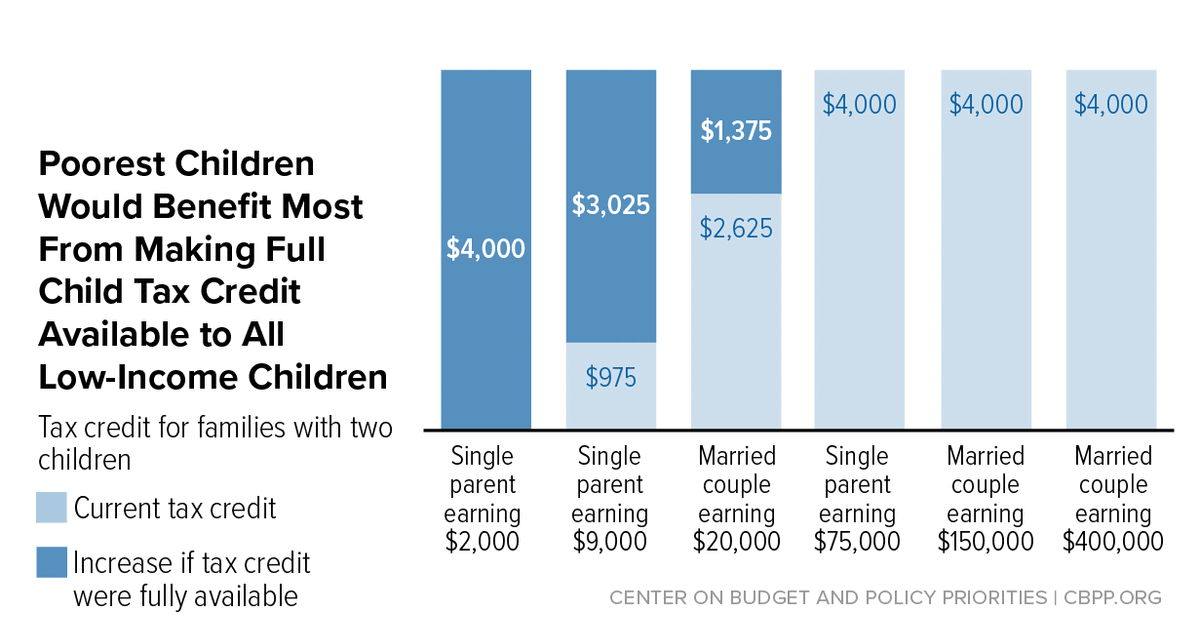

For example a family of four couple with two dependent. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings.

State By State Coronavirus Guidelines Tax Unemployment Resources

Pennsylvania How Unemployment Payments Are Considered

Unemployment Benefits Tax Issues Uchelp Org

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Unemployment Benefits In Ohio How To Get The Tax Break

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

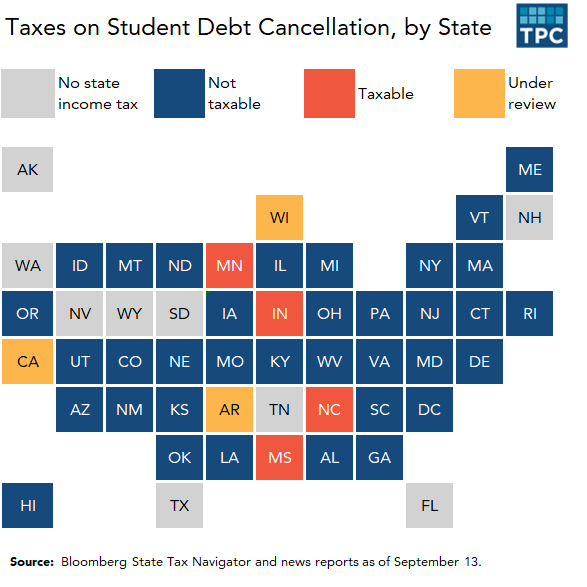

Which States Tax Student Loan Forgiveness And Why Is It So Complicated Tax Policy Center

State Conformity To Cares Act American Rescue Plan Tax Foundation

Pennsylvania A Budget That Takes Care Of Today And Plans For Tomorrow

Ways To Help Others In Need Archives Brinker Simpson

Pennsylvania State Tax Software Preparation And E File On Freetaxusa

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More Exploreclarion Com

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

Pa Business Community Applauds Budget Cut In Corporate Income Tax But Want More Done Pennlive Com

Here S How Pa Plans To Spend Its Billions In Federal Stimulus Money Full List Bctv

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/P6R4DVQ6M5HWJIRWVUG3NI7BJI.jpg)

Amnesty Plan For 613m In Pa Unemployment Payments

Total Covid Relief 60 000 In Benefits To Many Unemployed Families