www tax ny gov online star program

Enter the security code displayed above. If you purchased your primary residence.

You should register for the STAR credit if you are.

. Select Delivery Schedule lookup below. The following security code is necessary to prevent unauthorized use of this web site. The benefit is estimated to be a 293 tax reduction.

RPTL 425 6 a-2 authorizes the department to extend the filing deadline and grant the exemption if it is satisfied that i good cause existed for the failure to file the application by the taxable status date and. Exemption forms and applications. In the first year that you apply for the Enhanced STAR exemption your assessor will verify your eligibility based on the income information you provide.

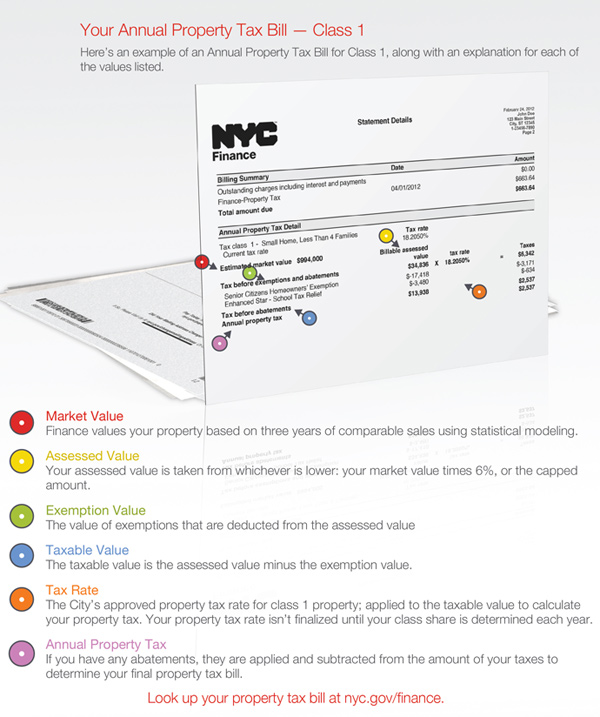

You must file exemption applications with your local assessors office. The HTRC is a one-year program to provide property tax relief in 2022. All New Yorkers who own and live in their one two or three family home condominium cooperative apartment manufactured home or farm dwelling are eligible for a STAR exemption on their primary residence.

The homeowner tax rebate credit is a one-year program providing direct property tax relief to about 25 million eligible. The STAR program is an ongoing program to provide school tax relief to. See Municipal Profiles for your local assessors mailing address.

Home are eligible for the STAR exemption on their primary residence. STAR School Tax Relief exemption forms. Enter the security code displayed below and then select Continue.

Select your town or city. Enter the security code displayed below and then select Continue. You only need to register once and the Tax Department will send you a STAR credit check each year as long as youre eligible.

We recommend you replace any bookmarks to this. Page last reviewed or updated. Do not file any exemption applicationsexcept Form RP-425-GCwith the Department of Taxation and Finance or with the Office of Real Property Tax Services.

The STAR Check Delivery Schedule lookup provides the most recently updated information available for your area. Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application instructions above STAR forms. Choose the county you live in from the drop-down menu.

STAR is New York States School Tax Relief Program that provides tax exemptions to. Basic STAR is for homeowners whose total household income is 500000 or less. If you are using a screen reading program select listen to have the number announced.

To use the lookup. The intent of the Good Cause program is to grant the exemption to seniors who missed the deadline for a sufficient reason. STAR is New Yorks School Tax Relief Program that provides a partial exemption from school property taxes.

The STAR program can save homeowners hundreds of dollars each year. If you are using a screen reading program. With an Online Services account you can make a payment respond to a letter from the department and moreanytime anywhere.

All Enhanced STAR recipients are required to participate in the Enhanced STAR Income Verification Program IVP. To be eligible for Basic STAR your income must be 250000 or less. In the following years we will verify your income eligibility.

Select your school district to view the information for your area. If the school taxes in your community are due by September 30 and you purchase the home on September 15 you will become eligible for STAR that year as long as you. If you dont already have an account its easy to create one.

We changed the login link for Online Services. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes. Online Services is the fastest most convenient way to do business with the Tax Department.

STAR Check Delivery Schedule. The total income of all owners and resident spouses or registered domestic partners cannot. Visit wwwtaxnygovonline and select Log in to access your account.

If you are using a screen reading program. Register for the Basic and Enhanced STAR credits. You will become eligible for the STAR credit in the first year that you own the home and it is your primary residence as of the date that school taxes are due.

STAR helps lower property taxes for eligible homeowners who live in New York State school districts. New York City residents. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live.

You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply. The following security code is necessary to prevent unauthorized use of this web site. See the STAR resource center to learn more.

You currently receive Basic STAR and would like to apply for Enhanced STAR. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. All New Yorkers who own or have life use and live in their.

The School Tax Relief Star Program Faq Ny State Senate

City Of Lackawanna Welcome To Lackawanna

City Of Lackawanna Welcome To Lackawanna

New York Property Owners Getting Rebate Checks Months Early

210m Upgrade For Grand Central S Subway Unveiled

Crisis Reputation Management Services New York New Jersey In 2021 Online Reputation Management Reputation Management Online Reputation

Receiver Of Taxes Town Of Oyster Bay

Homeowner Tax Rebate Credit Check Lookup

New York Dmv Sample New York Dmv Photo Documents

Nyc Residential Property Tax Guide For Class 1 Properties

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos Tax Forms 1099 Tax Form Irs Forms